The IRS May be Getting a Massive Budget Increase. Will It Impact the Audit Rate? – C&A Financial Services

In September of 2021, the Congressional Budget Office announced a proposal to increase funding for the Internal Revenue Service by as much as $80 billion over the next ten years. The argument is that doing so would ultimately increase the revenue the organization is able...

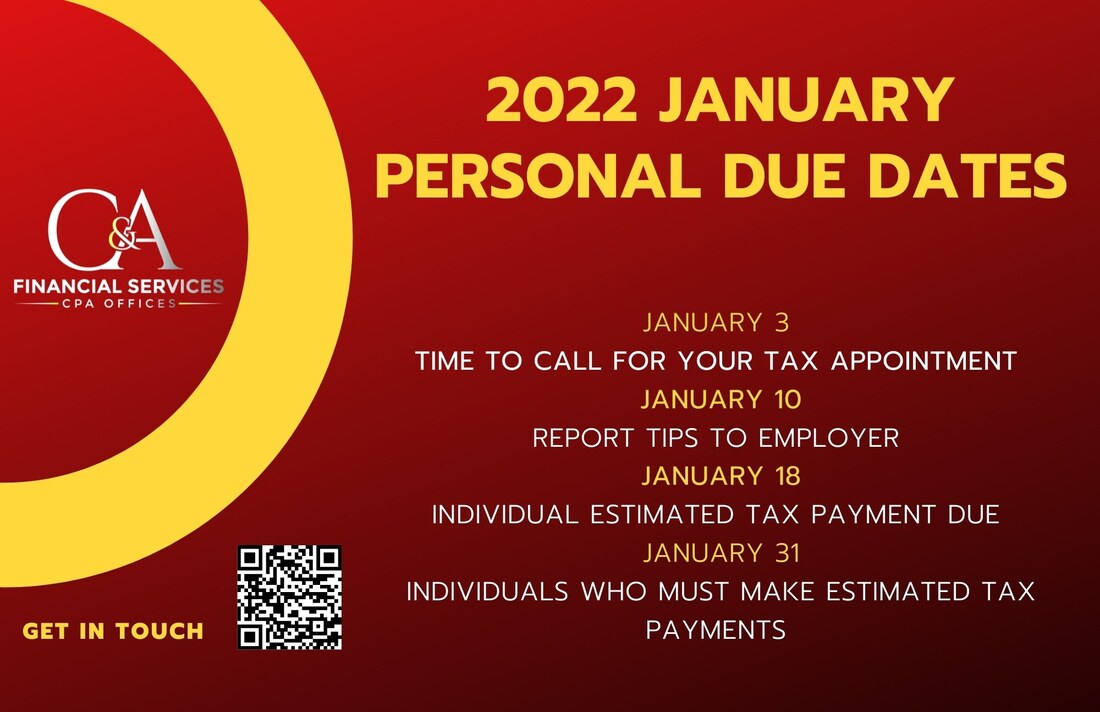

January 2022 Personal Tax Related Due Dates – C&A Financial Services

January 3 - Time to Call For Your Tax Appointment - January is the beginning of tax season. If you have not made an appointment to have your taxes prepared, we encourage you to do so before the calendar becomes too crowded. January 10 - Report Tips...

Tax Return as Married Filing Joint vs Separately. IMPORTANT!!! – C&A Financial Services

Married taxpayers have two options when filing their 1040 or 1040-SR tax returns. The first and most frequently used filing status is married filing joint (MFJ), where the incomes and allowable expenses of both spouses are combined and reported on one tax return. The joint...

Tax Benefits for Disabled Taxpayers and Dependents

Disabled individuals, as well as parents of disabled children, may qualify for a number of tax credits and other tax benefits. Listed below are several tax credits and other benefits that are available if you or someone listed on your federal tax return is disabled. Increased...

New Cryptocurrency Tax Requirements – C&A Financial Services, CPA Offices

Article Highlights: IRS Compliance Campaign New Reporting Requirement for Crypto Exchanges Form W-9 Form 1099-B Cryptocurrency as Property Digital Assets Definition Transfer Reporting Cash Transaction Reporting 1040 Crypto Question Over the last 3 years, the Internal Revenue Service has been engaged in a virtual currency compliance...

Tax Breaks for Primary Caregivers of Grandchildren

Article Highlights: Head of household filing status Earned income tax credit Child tax credit Child care credit for certain working grandparents Grandchild education credits Medical and dental expenses More and more individuals who thought their child-rearing days were over are now raising their grandchildren. It is...

Watch Out for Tax Penalties

Article Highlights: Underpayment of Estimated Tax and Withholding Penalty Required Minimum Distribution Penalty Late-Filing Penalty Late-Payment Penalty Negligence Penalty Fraud Penalty Dishonored Check Penalty Missing ID Number Penalty Early Withdrawal Penalty Penalty for Failure to Report Tips Foreign Reporting Excessive Claim Penalty Accuracy-Related Penalty for...

Important Tax Tips for Holiday Charity Donations

During the holidays, many charities solicit gifts of money or property. This article includes tips for documenting your charitable gifts so that you can claim a deduction on your tax return. Cash Donations – To claim a charitable deduction, you normally must itemize your deductions. However,...